It shouldn’t be FREE: You appreciate it if you pay for it.

November 26, 2020

by drplasticpicker

I’m nominally a Physician Personal Finance Blogger. I’m on Crispydoc’s blogroll. Let me check to make sure I’m still there. https://www.crispydoc.com/physician-finance-bloggers/ Yep, still there. I like how CrispyDoc describes me, ” Dr. Plastic Picker is a self-described ‘wannabe financial blogger’ aiming to FISE (Financial Independence, Save the Earth). Written by a pediatrician and mom, this half of a west coast dual MD household is passionate about saving money and the planet.” That’s me. I’m actually a wannabe financial blogger because I don’t think physicians are the best equipped people to give other physicians financial advice. Did I just say that? Yes I did! You can listen to Dr. McFrugal. He gives solid advice. https://www.drmcfrugal.com/ I don’t like the travel hacking part of his blog, because this encourages folks to spew carbon into the air. But the minimalism and plant-based eating is point on. No one is perfect, not even Dr. McFrugal. His family is pretty adorable though.

Anyway, it’s 6am and I’m OOO. I just learned this term from NextGen’s Instagram account. There are a youth environmental movement. They are OOO, Out Of the Office. Those kids are so smart. So what does Dr. Plastic Picker do when I’m OOO on a holiday that we no longer celebrate? Yes our house no longer celebrates what was previously known as Thanksgiving. We call it Turkey Day, National Day of Mourning for the Wampanoag Tribe https://wampanoagtribe-nsn.gov/wampanoag-history, or Chef Craig an Instagram popular West Apache Culinary Wizard specializing in Indigenous Foods calls it “Indigenous Foods Day.” Those all sound better to me.

So it’s 6AM and I’m OOO, and what does Dr. Plastic Picker do? I promised myself I’d disconnect today from work and environmental advocacy. I don’t want to send emails on a day when most are spending with their families. I plan to go for a plog today, and we are going to make turkey lasanga, stuffing, and a salad for dinner. Mr. Plastic Picker is working at the Hospital. Despite us not celebrating “Thanksgiving, ” we’ll take the overtime holiday pay though! The top income earner in our house never passes on a chance for premium overtime, despite us being now financially independent and reaching our financial independence number.

How do you dear readers know that we are FI? We could be lying. But really, why would we? Plus it’s not good to flaunt one’s financial wealth because of the gaping income inequality in the country. We made reasonable salaries comparable to other doctors. We are at our FI number because we are super frugal, lived well below our means sometimes at a 60% savings rate, and we know that money is just a means and not the be all or end all of anything. Case in point, both of us are still working and moving forward in our careers because we both need purpose.

One number I did want to share today was the remaining balances on our student loans, and the interest rate.

Remaining School Loan Balances

| 61,672 | 1.60% |

| 11,054 | 1.80% |

We could pay off the loans right now, no problem. It wouldn’t even phase us. I’ve sat on several resident panel discussions on financial literacy and planning with other physicians. I’ve talked about student loan payback with other physicians seeking my financial advice. Everyone’s situation is very different. We were lucky in the sense that we graduated and consolidated our loans at a time when the interest rates were super low. Yet we also would give back at least $8,000 every year back to the financial aid department because we didn’t use what the school thought we needed. We worked also as premed advisors for room and board, spending all our free time with students which was fun – but also reduced our costs. Mr. Plastic Picker and I also moonlighted all through the early years post-resdiency, chief residency year and fellowship – every opportunity there was to moonlight even with a young child at home, we did.

Back to those financial literacy conversations and resident panel discussions I’ve been a part of. I’ve heard other attendings give out advice about student loans that was nonsense. There are no absolutes. In depends on your interest rate, and what your life circumstance is. In general, after you become an attending – you will not be able to deduct your student loan interest payments (check with your accountant). I heard fellow physicians boast about paying back their student loans and chipping away at it quicker than the terms of payment. I just nod. Again, personal finance is very personal – so that may be a prudent thing for them to do. But I actually know that they will be in the middle of the class in terms of building networth.

Let me tell you why. You need to understand about opportunity cost. This I learned in AP Macro and Microeconomics in high school. I also learned this from my father. Mr. Money Mustache had a blog post years ago about how he thought of each dollar invested as a litte green employee that was working for him. I tried searching for that blog, and I can’t find it anymore. This one is good, plus I want to give him some blog credit. Although he has millions of cult-like readers! https://www.mrmoneymustache.com/2011/08/01/a-millionaire-is-made-ten-bucks-at-a-time/ That sentiment always stuck with me.

So I haven’t paid off our loans. I could pay them off now without a problem. The reason I don’t pay them off, is that they remind me what my education was worth and that I should keep on working. My parents could have paid for my entire education, but as a 21 year old – I was proud of my ability and wanted my independence. I actually told my parents I would pay for everything including living expenses from the time I was at the end of junior year in college. I remember my father signing loan papers for Crimson College, and it was a type of loan that was at a higher interest rate at about 6% back then and variable. I felt a great sense of guilt choosing to go to the Ivy League versus choosing to stay at the University of California system where I had earned a Regents Scholarship and essenitally could have gone for free. I found a merit scholarship that paid for most of my last year of college and had scrambled for little scholarships here and there that totalled about another $10,000. I worked the summers in college at labs and summer camps that looked good on my medical school application and made me some money to pay for applications. I actually paid for my own medical school applications and all my own travel. I was careful with planning strategically so that I grouped my travel together to save on flights. Other students would go on mini-vacations during those times, but I remember being acutely aware of how much my flight cost. My Ivy League education was an extravagance, but one that I knew I desired. It did help me get into medical school and I enjoyed my time there, and met Mr. Plastic Picker.

So the reason I don’t pay off our loans, is that I invest any savings instead after I’ve hoarded a chunk of money. I invest all that saved income into real estate, businesses, stock market. The marginal rate of return for a dollar that goes to investment even something as simple as the stock market index fund, versus paying down a student loan that is only at 1.6-1.8%. Especially our primary home. We bought something we could afford but bigger than we needed, because I was thinking about maximizing property appreciation and tax planning. Plus I can deduct many things from our primary home. That is why I haven’t paid off my loans. And with inflation, the real cost of our student loan debt is actually less.

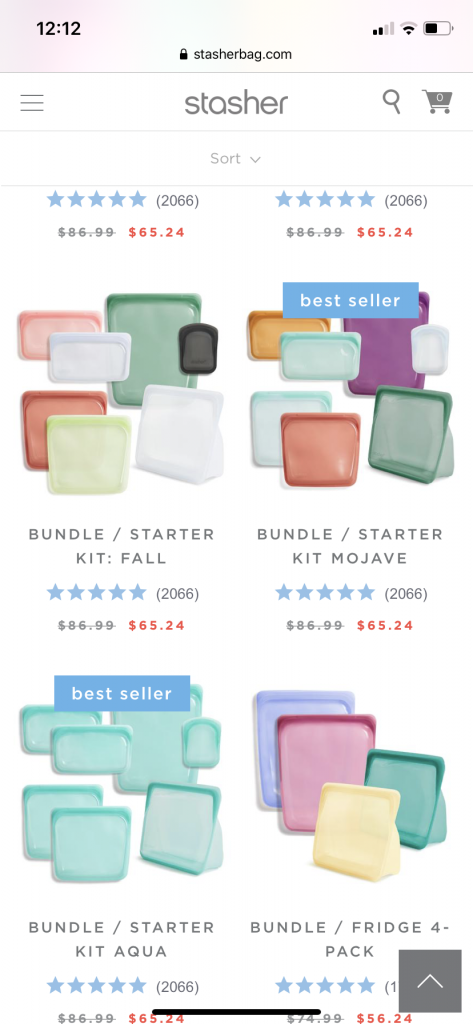

I was just updating our finances as everyone should a few times a month. I always think about our student loans, and we’ll have a small celebration those two dates that Mr. Plastic Picker pays his down and when I pay mine down. But we’ll celebrate not only because we have paid them off, but more that we dragged it out and focused on the long-game of building networth and financial freedom. And that is why I am going to buy some very important people in my life Stashers!!! They are super expensive but so eco-cool. They replace ziplock bags. The people I’m buying for them are really important to me and I got to ask them what colors they liked the best. Plus they are 30% off due to Black Friday. Otherwise we won’t buy much, expect for STASHERS!!! I wonder if they will let me be a brand ambassador? I won’t though. They are too expensive for most of the population. You don’t have to have Stashers to save the planet and reduce your plastic. But Dr. Plastic Picker is FISE, Financially Indepndent to Save the Earth and I can afford it this morning. Mr. Plastic Picker is working overtime. It’s amazing that the younger physicians in his practice are not. What in the world are they doing? I guess they are OOO, Out of the Office. LOL. Just like with the environmental movement, at work you need to show up. And that’s the message from Assistant Boss of Pediatrics.

1 thought on “It shouldn’t be FREE: You appreciate it if you pay for it.”

-

Pingback: Left-Over Anything (Turkey) Stew: $0 – Dr. Plastic Picker