Road to FISE: Keeping Our Financial House in Order This Weekend

August 8, 2020

by drplasticpicker

I had a fun experience speaking on a virtual panel, as part of the HMO Family Practice Residency Didactics regarding Financial Planning. The residents had very basic questions about financial planning. I may or may not blog about it later. I thought I offered a helpful perspective being a woman and one in administration and leadership. The residency is predominantly female. My advice was very different than the men. It’s funny how writing organizes your thoughts, as I found myself parroting sentences from my various blog posts. They are my blogposts and my words, but it was interesting that I know I had written them first before I spoke them.

But that didactic on Resident Financial Planning did remind me to keep our own financial house in order. Things have been going well, despite my brief diversion into COVID-19 testing and self quarantining the last 48 hours. The COVID-19 test was horrible by the way! I felt like they were poking out my brain. I didn’t think I had COVID-19. I really had no symptoms. But who knows all the different presentations of COVID-19 anyway? I rewatched Star Trek Enterprise again and watched the one episodes of the new animated Star Trek Lower Decks, which was pretty funny while I was waiting for my test results.

But now I’m as COVID-19 free as anyone else, and it is the weekend. I almost finished our tax paperwork so will really get it done this weekend. I tried not to sound too superior yesterday to my male colleagues when speaking to the residents. But I had to be articulate and impress upon the younger female physicians that as working high-earning woman, we need to be good financial managers. I told them in all honestly that I manage all our family’s finances. It was only after I took it over from my husband that our networth started growing well. Eventhough I am the “lower” salary, that between my investments and management – half of our networth is due to my efforts. I think I impressed them when I mentioned wills and living trusts, and that as high-earning women you have to structure your will in a way to ensure that your children will get your earnings in the event of your death and when/if your spouse remarries. I told them “I love my husband and we’ve been together since I was 19. But I’m not stupid. I’ve seen too much of the realities of life go through my office.” I think that really woke them up!

But the reality of life, is that I have Financial Housekeeping to do today.

- Finish Our Tax Paperwork: Goal is to have everything ready to drop off at our accountant’s office later today or tomorrow. We already save our quarterly taxes in a separate fund so when it’s time to pay up to the federal and state government, we always have a bit left over. I like to oversave by a few percentage and we have a little gift of a few thousand at the end. We end up saving it as well, but it’s nice to have that extra money in the tax fund. It’s a psychologic game I play with myself.

- Consider Refinancing Several Properties: The interest rates are very low right now. I need to figure out whether we should refinance several of our properties. I can’t do the calculations until I hear about what the rates would be for our credit score. I emailed my mortgage broker a week ago and have not heard back. I’ve worked with her for over a decade. She’s fast and efficient. But in the end of the day, she is making her commission as well. Funny thing is after a decade of our working relationship, I’ve never actually met her. There has been no reason. If not, I have another mortgage broker I can work with that I will contact. I told my own old mortgage broker that. Competition is always good. LOL.

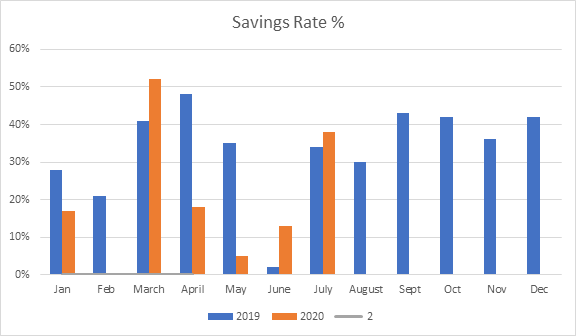

- Looking at Savings Rate: I mentioned to the residents that they should keep track of certain numbers which is their networth and their savings rate. In the end of the day, there is no rocket science to personal finance. You have to make money, and save some of it. Then you invest it. That is how money grows. Yes there are many ways to invest, and we do index funds and safe residential real estate. But the key is to save some money first. I finished updating our basic monthly finances. Since I’m only a Wannabe Financial Blogger https://drplasticpicker.com/wannabe-personal-finance-blogger-but-i-dont-want-to-retire-until-58/, I don’t publish a monthly update on where we are financially. Plus I don’t feel that comfortable publishing our actual financial numbers. But the savings rate is kind of innocuous to let people know. Overall in 2019 our savings rate as a total of net income was 50% with forced retirement savings included, and without retirement savings was 38%. Due to COVID-19, Mr. Plastic Picker did not do his usual overtime work and everyone had hours cut. We were still able to save but as you can see April and May our savings rate dropped quite a bit. Year to date 2020, we are at 28% without retirement. With our retirement savings (we max out what is allowed every year), we are still close to 50%.

Ooooh I feel so fancy now because I inserted a graph into a personal finance blogpost. It is helpful though. I figure being a Wannabe Personal Finance Blogger https://drplasticpicker.com/wannabe-personal-finance-blogger-but-i-dont-want-to-retire-until-58/ is good for us financially, as it will keep me on track to continue to build our networth. We already could retire early, but really – retire early to do what? We would rather be FISE – Financially Independent to Save the Earth https://drplasticpicker.com/fise-financial-indepedence-and-save-the-earth/! With that independence I will do our monthly environmental donations now. Its already the 8th of August, and I’m late on my committment to the earth. https://drplasticpicker.com/donation-round-up/