Cold Brew Coffee: Did you Finish Your Living Trust & Will?

July 7, 2020

by drplasticpicker

When I was a freshman at Crimson College, we were required to be part of the meal plan where our parents had to pay a set amount yearly for unlimited meals at the residential dining hall. The reasoning from Crimson University is that unrestricted communal eating in the classic House Dining Hall setting promoted a shared university experience. For over a decade, Mr. Plastic Picker and I ate countless meals at Hufflepuff Dining Hall and much of our university experience as undergraduates, medical students and later as advisors centered around those late hours in the dining hall chatting with friends and students.

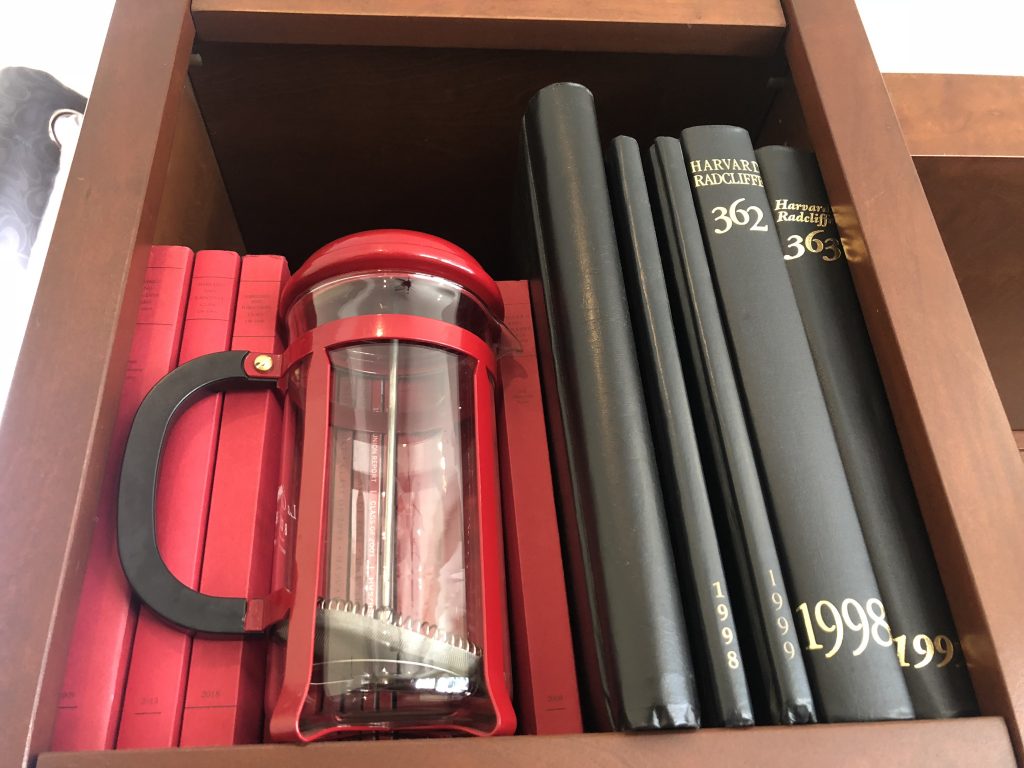

There was a sort of food court that was open in the basement of Memorial Hall, where we were given a limited amount of food credit dollars to spend. During my first year, I hoarded that credit and bought a Crimson French Press. I’ve carried this French Press with me for from Cambridge to DC to Southern California. I used it for the first time in 20 years. It’s Plastic Free July, and I made Cold Brew Coffee.

Even during my first years of college, I was smart about my time and money. I remember the Dean at Hufflepuff college asked me to babysit his three children for $8 an hour. I always liked children (I am a pediatrician) but was never one that needed to be in their constant presence. I was already a volunteer director of an afterschool ESL program for refugee children during college. Trying to decide to take this babysitting job from the Dean, I remember thinking was that my parents were paying $150 an hour for me to be at this university and the whole point was to get into medical school. $8 versus $150 and I needed at least at least an A- in Advanced Organic Chemistry. The financial math and the GPA calculations did not work out. So I turned down the offer to play puppets with the Dean of Hufflepuff College’s children and studied for my Organic Chemistry midterm.

Now I’m in my early 40s, much of the same age that the Dean of Hufflepuff College was. Now I realize that cheap student labour and free meals were a perk of his being an academic dean. But he was never a particularly good advisor to me and I remember giving me bad academic and financial advice, and did not receive tenure. He ended up leaving Crimson University and becoming faculty at a private school, where his three children attended again as a perk for his teaching. I thought that situation was always very interesting and a snapshot of the transactional relationships within university settings.

And marriage is a transactional relationship as is being a parent. Dr. Plastic Picker does not glorify money, but I realize that money is what our society uses as a proxy for time and effort – if it is justly earned. My money and my net worth, in that I earned it from honest labour and honest business dealing, is a reflection of decades of my time and efforts. If one thinks of money that way, than marriage and parenthood are relationships that requires time and effort and is transactional. I love my family dearly and I have spent years of time and labour building my marriage and my relationship with my children. It is important at this juncture to ensure those relationships through a Living Trust and Will.

Mr. Plastic Picker and I finished our Living Trust and Will last summer, and it was the best decision we ever made. We should have done it sooner, but at least it is done. When we worked with our vetted Trust and Estates Attorney, it was amazing how in step we were about what our wishes were in relation with how we wanted the sum of our money to go – the remnants of a lifetime of time and honest labour of two physicians to our children and to the world.

This blog has never been a how to guide, but rather I hope serves as an inspiration for the readership to care for themselves and care for the earth. Much of the reason I feel Financially Independent to Save the Earth is because I have completed our financial planning, and completed our Living Trust and Will and written out our last wishes. Our children are in their tween and teen-years, but they also have been told our expectations for them and what we will provide for them. I wanted to give you a snapshot into our thinking process, especially as a fully employed working woman physician as how we approached our Living Trust and Will.

10 Interesting Points About the Plastic Picker Family’s Living Will and Trust

- Dr. Plastic Picker knows that half of our networth is due to my labour and my real estate investments. Mr. Plastic Picker is a specialist specialist and his income is about double my income. But as a pediatrician, I’m not small potatoes. Plus I’m the Chief Financial Officier of this family. I’ve kept meticulous records of how our networth has grown, and through my real estate investing and income – half of our networth is earned by me. I remind Mr. Plastic Picker of this anytime he gets a bit too big for his britches LOL Lesson, girl know what you are worth!

- We Chose A Vetted Trust and Estates Attorney. There are times to get a bargain, but picking someone to help guide you through the Living Trust and Will process is not the time to go cheap! We picked at attorney that was vetted through multiple channels and we did our research. Our estate is complicated for various reasons and it cost us $5000 which is the going rate. Our attorney has over 30 years of experience. Lesson, don’t try to get a bargain with a Trust & Estates Attorney. Pay extra for piece of mind because we are talking millions of dollars here!

- Mr. Plastic Picker & Dr. Plastic Picker dearly love each other, but our distrust is in other people. The wonderful thing about finding the love of your life when you are college students, was that you fall in love before all the complications of salary and children and social position. Honestly, Mr. Plastic Picker will always be to me the cute college junior who loved creative writing. To others, he is a high income earner. I once had a divorced father in clinic mention to me, “I should have married someone like you.” I remember thinking that was the point that my profession and income defined who I was in the eyes of so many out there. I felt grateful to have met my life partner when I was just me, and not Doctor me. In that, we both have an inherent distrust of make-believe spouses that may come and try to infiltrate our relationship. We also have an inherent distrust of make-believe 2nd spouses of our children. There are no divorces on either side of our family, but we live in the real-world and know life does not always turn out as planned. Therefore we picked a Revocable Trust during our lifetime, and that on the moment of our death becomes an Irrevocable Trust, and then a Generation Skipping Trust. Please consult a Trust and Estates Attorney, but in general what we protected our assets from a potential second spouses and our children in the case they get divorced. This is vital for women who are high income earners. No matter what, when I die, my children get my half. Lesson, love your partners and family with an open heart but beware of others.

- In the Case of Inherited Weath, Decide who gets what. Both our parents have assets. We will both likely inherit something from our parents. We have told our parents, that we are financially set and don’t need an inheritance but knowing how our respective parents are – there will be assets passed down. For me, I know that psychologically my own father has had a lifetime of business brilliance and I am protective of how people look at him and his money. I hope that he gives it all away to the cause that is close to his heart. But in the case of inheritance, it is psychologically very important for me that anything I inherit goes to my children. Mr. Plastic Picker feels the same away about certain assets that his parents have. We set up a bypass trust, where in the case of our deaths should preceed our parents, those assets would bypass the spouse and go to the children’s irrevocable generation skipping trust. Lesson, merging two families is complicated as it always merges some money. Have those tough conversations now.

- Pick Your Trustees Carefully. Both Mr. Plastic Picker and I come from 4 siblings each. Each of our sibling groups are from the same biological set of parents. This makes planning easier when we were thinking of who the guardians for the children would be, and who the trustees would be. It’s again amazing that we were in complete agreement who were the best financial stewards and the best potential guardians to finish raising our children would be. They were not the same people. Lesson, have those tough conversations now on who you trust to financially manage your trust and who you trust to raise your children in the even of your early death.

- Finish the Details. Finishing the Living Trusts and Will was a fun process for us, but we needed to commit to it as a summer project. It required several visits to the Attorney’s office. We had to do financial homework and planning. Our estate is more complicated than others, and we had to organize a lot of paperwork. And even after finishing the Living Will and Trusts, we had to transfer assets to the trusts and update documents like retirement account beneficiaries. This is what makes the difference between dying and things going smoothy versus dying and leaving a financial mess. You have to commit time and finish the planning and paperwork. Lesson, realize that this s a months long project and devote your time to it as a couple and get it done.

- You Discover Things About Your Loved One that Will Delight and Shock You. Mr. Plastic Picker and I have been together for 22 years between dating and marriage. But even then, you can learn things about each other when discussing Living Trusts and Wills with an attorney. You are essentially setting down in a document your financial and moral values. We are mostly in sync but we learned things about each other that we did not know. It was delightful and at times shocking. We have very definite ideas of how we will be buried and I was adamant about making sure no part of my body would be part of augmented human/cyborg or be cloned. Yes, that is part of our health documents that are now enshrined. Lesson, enjoy the process with your partners and it should make your marriage stronger.

- Allowing your children the space to work for their own future. As with most Living Trusts and Wills, we have the standard provisions that provide for the children for college and graduate school and basic living expenses in case we die. But the bulk of our estate won’t go to them until they are 40 years of age. We picked a later date and our attorney was surprised. Mr. Plastic Picker and I were both in agreement. They will be given more than enough, and too much money can ruin people. Lesson, again have the hard conversation about how money can help or hurt people.

- Financial Weight Lifted Off Our Shoulders. This was a project that we had been putting off for 10 years. Honestly, I was busy working, optimizing our savings rate, and then real estate investing. But after we finished our planning and both had a birds eye view of what the tragic “if” would be “if” we died, we were at peace and realized that the kids would be okay. Both of us after each attorney meeting had to leave for various work committments in different cars, but each time we did something to finish the planning – we felt emotionally lighter and more free. In the end for us it has always been about the children and we remain simple people with simple wants, and we know we are doing our part. Lesson, you will be happier when you get this done.

- Share that you’ve done your Living Trusts and Will, and Other Will Follow Suit. I act as the informal spiritual financial guide for many of my co-workers. After we had our documents done, I know at least five people who had heard about our planning and asked for our thoughts and recommendations. Personal Finance in its essence is so personal, but I think we encouraged others to finish their Living Trusts and Will and that made us happy. Lesson, good financial planning like anything that is good can be infectious.

And that is it! That is the FISE post I’ve always wanted to write about Living Trusts and Wills. Below is the picture of the cold brew coffee I made that was surprisingly easy. I finally used a French Press I had saved from college. I’m glad I saved money to buy the Crimson French Press, and now it will help me make plastic-free coffee and get me off the instant packets. I’m glad I met that handsome college sophomore English maker who would end up being Mr. Plastic Picker. We are college sweathearts who finished our Living Trust and Will. And I’m glad I didn’t do that babysitting job and instead studied for my Organic Chemistry midterm, because it was $8 an hour versus $150 an hour in tuition. And Dr. Plastic Picker is the end is so FISE, Financially Independent to Save the Earth. I think we’ll plant more trees this month through Eden Reforestration Projects. My 942 Instagram followers like it when I plant a tree for them. It’s only $0.10 a tree so $94.2 and will provide oxygen for all of us, including our two children, for decades to come.

1 thought on “Cold Brew Coffee: Did you Finish Your Living Trust & Will?”

-

Pingback: COLD BREW COFFEE: A Nice Cup for a Nice Nurse – Dr. Plastic Picker